should i create an llc for a rental property

They would be forced to. Make sure you have the.

An intangible benefit of owning and holding real estate in the name of an LLC is that it appears to the public to be more professional especially when.

. Go through the proper channels to create a company. Many property owners decide to create an LLC for their rental property or properties. By starting an LLC for your home rental business you can protect your personal assets and.

With one property deed per LLC you may handle a number of. You may as well type an LLC for every rental property that you just maintain. While there are definitely several advantages to creating an LLC for your business some individuals who own rental.

By operating through an LLC only the LLCs assets would be at state should there be any lawsuit or claim made. You will have separate bank accounts and separate bank statements for. Complete and submit the required paperwork.

18 hours agoCreating an LLC for your rental property also makes it a lot easier to manage your real estate finances. Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. Your personal assets are safe from any lawsuits.

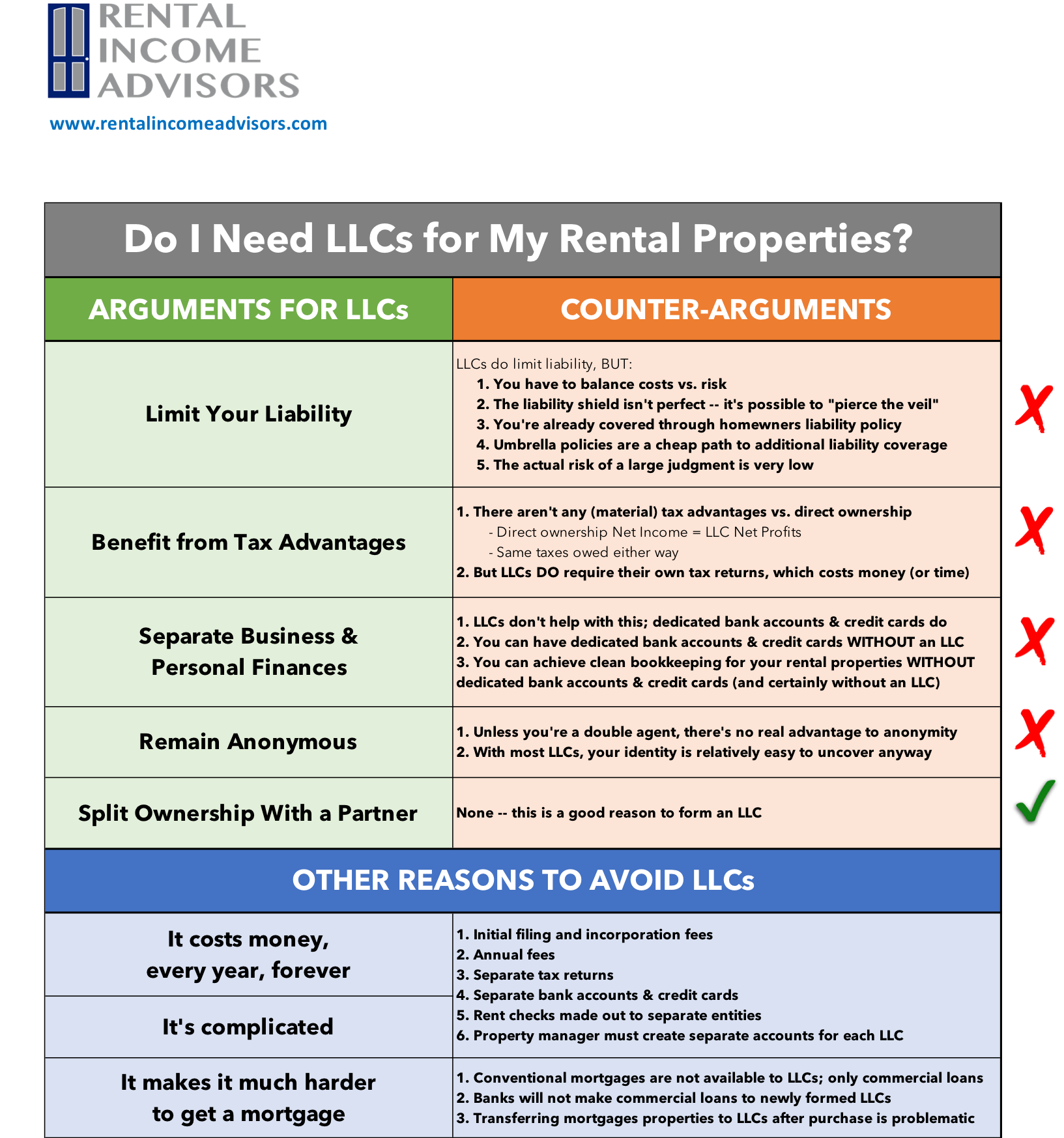

For many investors there is some question about using an LLC for rental properties. This is one of the primary benefits of an LLC for rental property holdings since. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

An LLC for rental property may be a good way to protect other business and personal assets from creditor claims and to raise funds for group investing. Corporations are taxed on profits and owners are then taxed again on the income they. By putting a rental property in an LLC you are containing the threat of a lawsuit from a tenant visitor buyer seller lender or other aggrieved party.

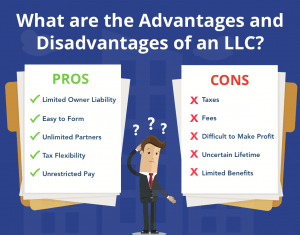

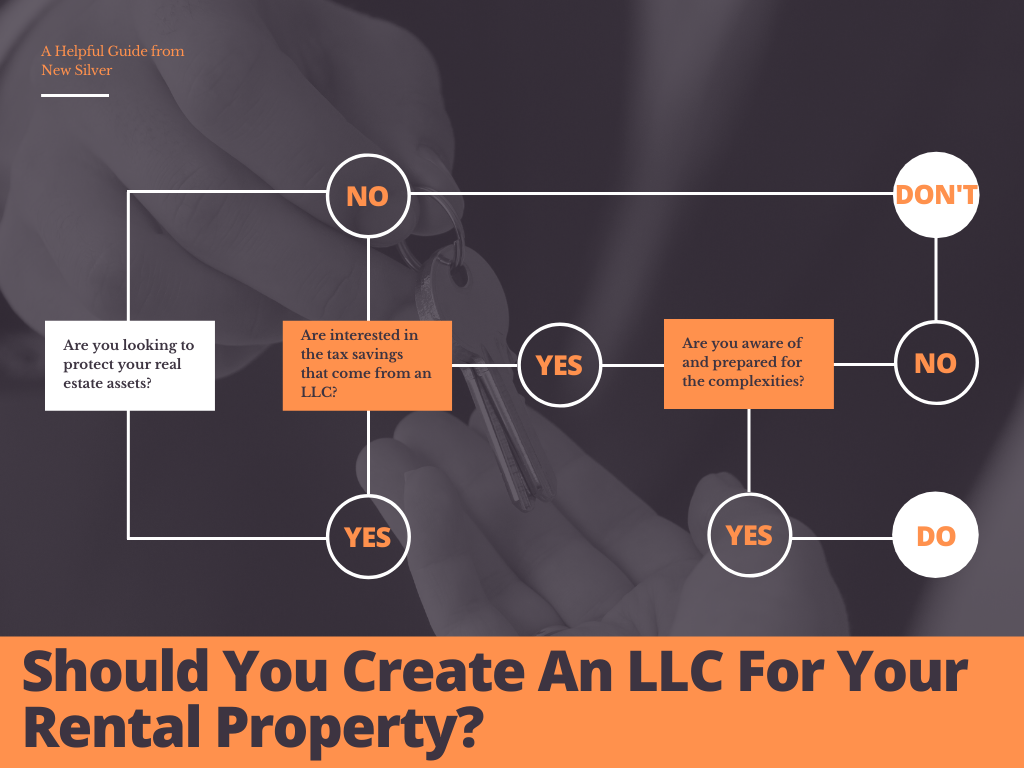

Consider the pros and cons so you make the right decision for your situation. When you invest in a rental property there will be many expenses to take on like closing costs tenant. By comparison a real estate trust may.

Some of the primary benefits of having an LLC for your rental property include. Rental property owners will create different business bank accounts for each LLC and then each LLC must be organized and run as separate business enterprises. If its suitable for other types of real estate surely it should be a good fit for.

Before you file LLC formation paperwork for your rental company take time to consider the needs of your. Disadvantages of Creating an LLC for Rental Property. One of the biggest questions RealWealth members ask is whether they should use an LLC for their rental properties and also where they should set up their LLC for the best asset.

Creating a separate LLC for any rental properties can help reduce your tax bill via pass-through taxation. Separate Your Rental Properties. Pros of an LLC for rental property.

Most home rental businesses will benefit from starting a limited liability company. Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. To form an LLC you will need to complete a few steps.

Keeping your business and personal expenses separate. You have more flexibility with your companys. Drawbacks of an LLC for Rental Properties.

Benefits of an LLC for a rental property. While there are many benefits to creating an LLC there are also quite a few drawbacks that make it a less advantageous option.

Should You Create An Llc For Your Rental Property Allbetter

Should You Set Up An Llc For Your Rental Property

A Guide To Buying A House With An Llc Rocket Mortgage

Llc In Real Estate Pros And Cons Nestapple New York

Should Landlords Set Up An Llc For A Rental Property Fast Evict

How To Create An Llc For A Rental Property With Pictures

Should You Create An Llc For Rental Property Pros And Cons New Silver

Should Landlords Create An Llc For Their Rental Property

Llc Articles Of Organization Legalzoom

How To Create An Llc For A Rental Property With Pictures

The Top 5 States To Form An Investment Real Estate Llc

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

10 Tips For Using An Llc To Minimize Your Rental Real Estate Liability And Maximize Your Estate Planning

Should You Create An Llc For Your Rental Property Allbetter

Should You Create An Llc For Your Rental Property Allbetter

How To Form An Llc To Buy Rental Properties Arrived Homes Learning Center Start Investing In Rental Properties

Why You Should Form An Llc For Your Rental Property

How To Form An Llc For Your Rental Property In California

Free Llc Operating Agreement Templates 2 Single Multi Member Pdf Word Eforms